In the ever-evolving world of cryptocurrency, Dogecoin has emerged as a unique and controversial player. Initially created as a joke in 2013, this meme-inspired digital currency has since captured the attention of investors, enthusiasts, and skeptics alike. At the heart of Dogecoin’s distinctive identity lies its tokenomics – particularly its inflationary model, which sets it apart from many other cryptocurrencies. This article delves deep into Dogecoin’s tokenomics, exploring how its inflationary approach compares to other cryptos and what this means for its future in the digital currency landscape.

Understanding Tokenomics

Before we dive into the specifics of Dogecoin, it’s crucial to understand the concept of tokenomics. Tokenomics, a portmanteau of “token” and “economics,” refers to the economic model and mechanics that underpin a cryptocurrency. It encompasses various factors, including:

- Supply mechanisms: How new tokens are created and distributed.

- Scarcity: The total supply of tokens and whether it’s capped or unlimited.

- Utility: The purpose and use cases of the token within its ecosystem.

- Incentive structures: How the system encourages participation and maintains network security.

- Distribution: How tokens are allocated among developers, investors, and users.

Tokenomics plays a crucial role in determining a cryptocurrency’s value, stability, and long-term viability. Different models can lead to vastly different outcomes in terms of price behavior, adoption, and overall success of a cryptocurrency project.

Dogecoin: A Brief Overview

Dogecoin was created in 2013 by software engineers Billy Markus and Jackson Palmer as a lighthearted alternative to Bitcoin. Named after the popular “Doge” internet meme featuring a Shiba Inu dog, Dogecoin was intended to be a fun and accessible entry point into the world of cryptocurrencies.

Key features of Dogecoin include:

- Proof-of-Work consensus mechanism: Similar to Bitcoin, Dogecoin uses a PoW system for validating transactions and creating new coins.

- Scrypt algorithm: Unlike Bitcoin’s SHA-256, Dogecoin uses the Scrypt algorithm, which was initially more resistant to specialized mining hardware.

- Faster block time: Dogecoin has a block time of 1 minute, compared to Bitcoin’s 10 minutes, allowing for quicker transaction confirmations.

- Low transaction fees: Dogecoin boasts very low transaction fees, making it suitable for small, frequent transactions.

Despite its humorous origins, Dogecoin has grown into a significant player in the cryptocurrency market, often ranking among the top digital assets by market capitalization.

Dogecoin’s Inflationary Model

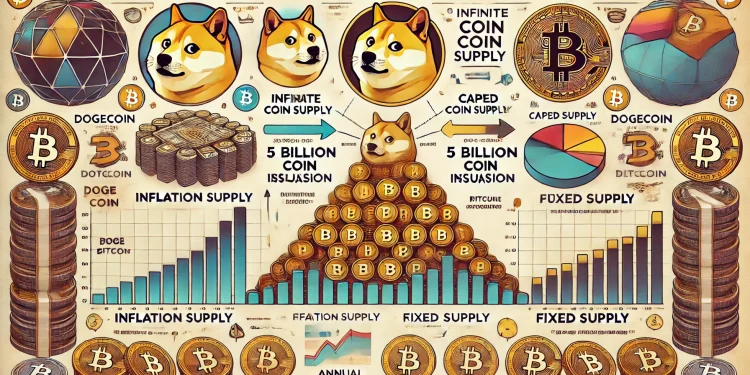

The most distinctive aspect of Dogecoin’s tokenomics is its inflationary model. Unlike many cryptocurrencies that have a capped supply (such as Bitcoin’s 21 million coin limit), Dogecoin has an unlimited supply with a fixed issuance rate. Here’s how it works:

- Initial supply: Dogecoin started with a supply of 100 billion coins, which was reached in mid-2015.

- Fixed block reward: After reaching the initial supply, Dogecoin implemented a fixed block reward of 10,000 DOGE per block.

- Constant issuance: With a block time of 1 minute, this results in 5.256 billion new Dogecoins being created each year.

- Decreasing inflation rate: While the number of new coins is fixed, the inflation rate decreases over time as the total supply grows.

This inflationary model is designed to ensure a steady supply of new coins, theoretically preventing excessive hoarding and encouraging spending and circulation.

Comparing Dogecoin to Other Cryptocurrencies

To understand the significance of Dogecoin’s inflationary model, it’s helpful to compare it to other prominent cryptocurrencies:

Bitcoin (BTC)

- Supply model: Deflationary

- Maximum supply: 21 million BTC

- Issuance: Halving every 4 years, current block reward is 6.25 BTC

- Inflation rate: Decreasing, currently around 1.8% annually

Ethereum (ETH)

- Supply model: Disinflationary (post-EIP-1559)

- Maximum supply: Unlimited, but with decreasing issuance

- Issuance: Variable, based on network activity and staking

- Inflation rate: Variable, potentially deflationary during high network activity

Ripple (XRP)

- Supply model: Pre-mined, deflationary

- Maximum supply: 100 billion XRP

- Issuance: No new coins created, tokens are released from escrow

- Inflation rate: Negative (coins are periodically destroyed)

Cardano (ADA)

- Supply model: Capped supply

- Maximum supply: 45 billion ADA

- Issuance: Decreasing over time

- Inflation rate: Decreasing, currently around 5% annually

Compared to these examples, Dogecoin stands out with its unlimited supply and fixed issuance rate. This approach has both advantages and challenges, which we’ll explore in the following sections.

Advantages of Dogecoin’s Inflationary Model

Dogecoin’s unique tokenomics offer several potential advantages:

- Encourages spending: With a constant supply of new coins, there’s less incentive to hoard Dogecoin, potentially increasing its use as a medium of exchange.

- Mitigates deflationary spirals: Unlike deflationary cryptocurrencies, Dogecoin is less likely to experience rapid price increases due to scarcity, which can lead to reduced spending and economic activity.

- Replaces lost coins: The steady issuance of new coins helps replace those that are lost or become inaccessible over time, maintaining liquidity in the system.

- Supports long-term mining incentives: The fixed block reward ensures that miners always have an incentive to secure the network, even after all coins have been mined (unlike Bitcoin, which will rely solely on transaction fees in the future).

- Potentially more stable: The predictable supply increase could lead to more stable prices compared to cryptocurrencies with fixed supplies, which can be subject to extreme volatility.

- Accessibility: The abundant supply and low individual coin value make Dogecoin psychologically more accessible to new users compared to high-value, scarce cryptocurrencies like Bitcoin.

These features align with Dogecoin’s original vision of being a fun, accessible, and usable cryptocurrency for everyday transactions and tipping.

Challenges and Criticisms of Dogecoin’s Tokenomics

Despite its potential advantages, Dogecoin’s inflationary model also faces several challenges and criticisms:

- Perceived lack of scarcity: The unlimited supply can be seen as a drawback by investors who prefer deflationary assets as stores of value.

- Potential for oversupply: If demand doesn’t keep pace with the increasing supply, it could lead to downward pressure on Dogecoin’s price.

- Inflation concerns: While the inflation rate decreases over time, some critics argue that the constant issuance of new coins could erode value in the long term.

- Concentration of wealth: A significant portion of Dogecoin is held by a small number of addresses, raising concerns about wealth distribution and market manipulation.

- Lack of supply adjustment mechanisms: Unlike some cryptocurrencies that can adjust their monetary policy, Dogecoin’s fixed issuance rate may not be able to adapt to changing market conditions.

- Perceived lack of seriousness: Dogecoin’s meme origins and inflationary model can sometimes be viewed as less serious or credible compared to other cryptocurrencies, potentially limiting its adoption in certain sectors.

These challenges highlight the ongoing debate in the cryptocurrency community about the ideal tokenomic model for a digital currency.

The Future of Dogecoin and Its Tokenomics

As Dogecoin continues to evolve, several factors could influence its future and the impact of its tokenomics:

- Technological developments: Potential upgrades to Dogecoin’s protocol could affect its tokenomics, such as implementing smart contract functionality or changing the mining algorithm.

- Market adoption: Increased real-world use cases and adoption could help absorb the ongoing supply increase and potentially stabilize Dogecoin’s value.

- Regulatory environment: Changes in cryptocurrency regulations could impact how Dogecoin’s inflationary model is perceived and utilized in different jurisdictions.

- Community governance: The active Dogecoin community may play a role in shaping future decisions about the cryptocurrency’s tokenomics and development direction.

- Integration with other platforms: Dogecoin’s use in decentralized finance (DeFi) applications or as a payment method on various platforms could influence its tokenomic dynamics.

- Market maturation: As the overall cryptocurrency market matures, perceptions of different tokenomic models may shift, potentially affecting Dogecoin’s position.

The long-term success of Dogecoin’s inflationary model will likely depend on how well it can balance its role as a medium of exchange with its ability to maintain value over time.

Impact on Investors and the Crypto Market

Dogecoin’s unique tokenomics have several implications for investors and the broader cryptocurrency market:

- Investment strategies: Investors may need to approach Dogecoin differently than deflationary cryptocurrencies, focusing more on its utility and adoption rather than scarcity-driven value appreciation.

- Portfolio diversification: Dogecoin’s inflationary model could serve as a hedge against deflationary assets in a diversified cryptocurrency portfolio.

- Market dynamics: Dogecoin’s price movements, often influenced by social media and celebrity endorsements, can impact overall market sentiment and highlight the role of community in cryptocurrency valuations.

- Educational opportunities: Dogecoin’s contrasting model provides a valuable case study for understanding different approaches to cryptocurrency tokenomics.

- Innovation catalyst: The success or challenges faced by Dogecoin could inspire new tokenomic models and innovations in the cryptocurrency space.

- Mainstream awareness: Dogecoin’s popularity has helped introduce many newcomers to the concept of cryptocurrency, potentially benefiting the entire ecosystem.

As the cryptocurrency market continues to evolve, Dogecoin’s inflationary model serves as an important experiment in alternative approaches to digital currency design.

Conclusion

Dogecoin’s inflationary tokenomics represent a unique approach in the cryptocurrency landscape, offering both opportunities and challenges. While its unlimited supply and fixed issuance rate contrast sharply with the scarcity-driven models of Bitcoin and many other cryptocurrencies, Dogecoin’s model aligns well with its original vision of being a fun, accessible, and spendable digital currency.

The ongoing debate surrounding Dogecoin’s tokenomics reflects broader questions in the cryptocurrency community about the ideal balance between store of value and medium of exchange functions. As the digital currency ecosystem matures, Dogecoin’s experiment in inflationary tokenomics will continue to provide valuable insights into alternative models for cryptocurrency economics.

Ultimately, the long-term viability and success of Dogecoin will depend on its ability to maintain user engagement, foster real-world adoption, and navigate the evolving regulatory and technological landscape of the cryptocurrency world. Whether viewed as a serious investment, a fun introduction to crypto, or a testament to the power of community in the digital age, Dogecoin and its distinctive tokenomics have undeniably left their mark on the world of cryptocurrency.